SHARE

SHARE

What Is a Skontro Ledger? A Practical Guide for Culinary Businesses!

Briantama Afiq Ashari

Do you often get confused when reading your restaurant’s financial reports?

Maybe it’s because you’re not yet familiar with the Skontro ledger—an important accounting format that makes financial reports clearer and easier to follow.

Let’s dive in and learn why this format matters for your culinary business!

What Is a Skontro Ledger?

The Skontro format, also known as a T-account, is an accounting format where one side records debits (left) and the other records credits (right).

This layout makes it easier to visualize money inflows and outflows in a simple “T” shape. It’s perfect for those who want straightforward yet effective financial records.

Why Culinary Entrepreneurs Should Know This

In the food business, cash flow is everything. With a Skontro ledger, you can quickly compare raw material costs (debit) against sales revenue (credit).

The result? Faster, more accurate operational decisions—ideal for small F&B owners still learning financial management.

Read Also: What is the importance of restaurant SOPs and what are examples of their implementation?

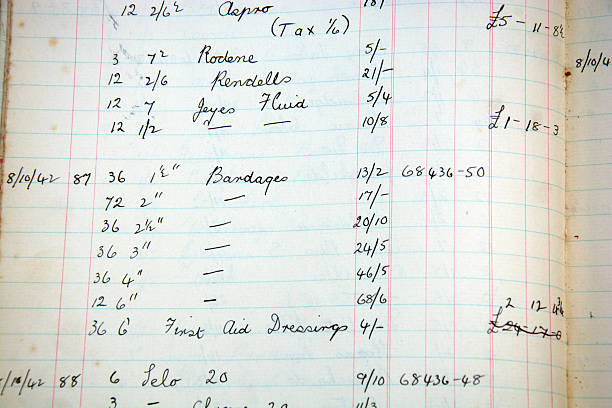

Example of a Skontro Ledger in Restaurant Operations

Source: detikfinance.com

Say you run a restaurant and buy supplies daily. On Monday, you purchase vegetables for Rp500,000 and earn Rp1,200,000 in sales.

Using a Skontro ledger, you record the purchase as a debit and the sales as a credit. Each day, you add new entries, instantly seeing the balance.

By the end of the month, all transactions are ready to be processed into financial reports—no need to recopy everything.

Skontro Balance Sheet: Why It’s Just as Important

Beyond ledgers, you should also know about the Skontro balance sheet. This shows your business’s financial position at a specific time.

The format is similar: assets on the left, and liabilities plus equity on the right. Through this, you can see:

- What assets your restaurant owns

- How much debt it has

- How much equity is left.

This helps you plan your next strategy, whether opening a new branch, buying new equipment, or delaying expenses.

Combining With Skontro Bank Reconciliation

Source: consultant

Ever noticed your bank balance doesn’t match your records? That’s where Skontro-style bank reconciliation comes in.

It helps you match your bank statements against your internal records—making it easier to spot discrepancies.

These could be due to:

- Bank fees

- Transfers not yet cleared

- Recording errors

With this method, you can quickly identify and resolve the issue.

- Skontro balance sheet: Assets on the left, liabilities and equity on the right. A clear picture of your financial standing.

- Skontro bank reconciliation: Matches bank balance with internal records. Discrepancies can be traced to admin fees, pending transfers, etc.

Read Also: Trying Omakase for the First Time? Let's Understand the Concept First to Avoid Misunderstandings!

Skontro vs Other Accounting Formats: Which Fits Restaurants Best?

The Skontro format is popular because it’s clear and easy to understand.

Compared to other formats, it makes data entry faster for staff and saves you time in monitoring daily transactions.

How to Make Skontro Ledgers More Practical

If you still rely on manual notes, you’ll likely face issues like lost records or overlapping reports. To avoid this, switch to a digital system.

With digitalization:

- Transactions are recorded automatically

- Skontro format is instantly available in real time

- Data can be shared with your team easily

- Recording errors are minimized.

This is especially crucial if you manage multiple outlets. With just one dashboard, you can access all financial data neatly in the Skontro format.

FAQ: Skontro Ledgers and Accounting

1. What is a Skontro ledger?

A T-account format where debit is on the left and credit is on the right—helping visualize financial transactions.

2. What’s the difference between a Skontro ledger and a Skontro balance sheet?

The ledger tracks daily transactions, while the balance sheet shows the overall financial position at a given time.

3. Why is this important for restaurants?

It helps check daily margins quickly, making decision-making more precise.

4. What’s the benefit of Skontro-style bank reconciliation?

It helps detect discrepancies faster, whether from bank fees, pending transfers, or misrecords.

5. How does a digital system help?

It automates recording, keeps data accurate, and makes it accessible anywhere—perfect for multi-branch operations.

Conclusion

Now you understand why Skontro ledgers, Skontro balance sheets, and Skontro bank reconciliations are crucial for culinary businesses.

This format makes financial monitoring easier, ensures transparency, and helps you make better strategic decisions.

If you want a system that’s practical, secure, and automated, the ESB ecosystem is ready to help. From daily transactions to end-of-month financial reports—everything is streamlined and efficient.

Contact the ESB Team today and discover the best digital solutions to grow your culinary business!

SHARE

SHARE